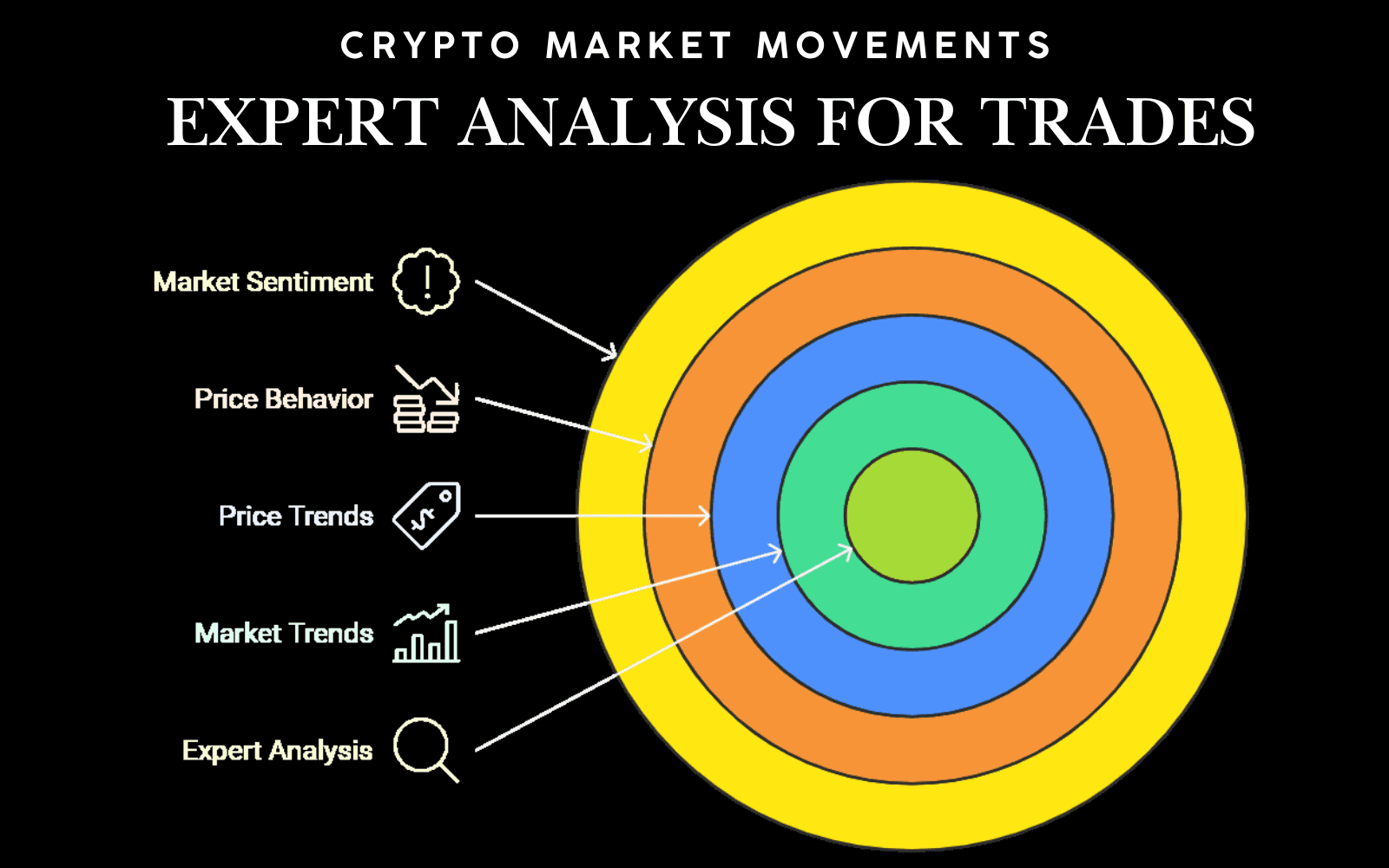

Crypto market trends are always changing, and keeping up with these shifts is crucial for successful trading. By analyzing crypto price trends, traders can identify profitable opportunities and avoid potential risks. Trend analysis is one of the most effective ways to understand the market, as it helps track patterns and price behavior.

Crypto market trends are always changing, and keeping up with these shifts is crucial for successful trading. By analyzing crypto price trends, traders can identify profitable opportunities and avoid potential risks. Trend analysis is one of the most effective ways to understand the market, as it helps track patterns and price behavior. Studies show that 75% of traders who use trend lines report better decision-making. Additionally, tracking market sentiment is key, as it reflects the overall mood of the market, helping traders adjust their strategies.

At PriceSync, we specialize in providing expert analysis of market movements, using real-time data to offer fresh chart setups. Our daily updates give you the tools to make more informed decisions, and our deep focus on crypto market trends means you stay ahead of the curve. With price action strategies tailored to current market conditions, we help you refine your trading approach for better results.

What is a Crypto Market Trend?

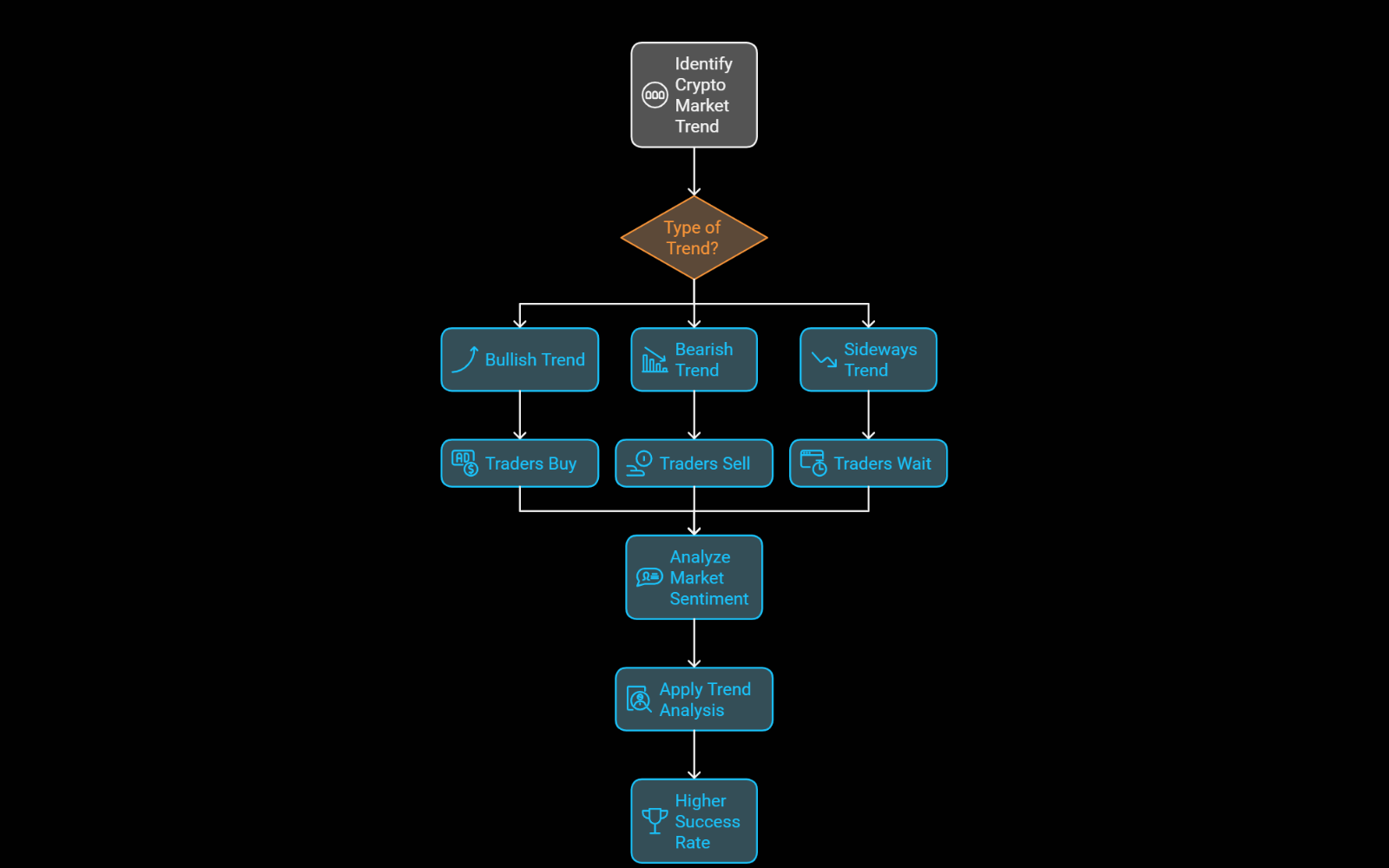

A crypto market trend is the overall direction in which the price of a cryptocurrency moves over a specific period of time. Recognizing these trends is vital for traders because it helps them decide when to buy, sell, or hold their assets. Trends can last for a few hours, days, weeks, or even months, and understanding them allows traders to predict future price movements, which is key to successful trading.

A crypto market trend is the overall direction in which the price of a cryptocurrency moves over a specific period of time. Recognizing these trends is vital for traders because it helps them decide when to buy, sell, or hold their assets. Trends can last for a few hours, days, weeks, or even months, and understanding them allows traders to predict future price movements, which is key to successful trading.

There are three main types of crypto market trends:

Bullish Trend:

A bullish trend occurs when the price of a cryptocurrency is rising over time. During a bullish trend, traders tend to buy, believing the price will continue increasing. Historical data shows that bullish trends account for around 60% of market behavior in the crypto world. For instance, Bitcoin has experienced significant bullish trends, especially after positive news such as institutional adoption or major technological updates.

Bearish Trend:

A bearish trend happens when the price of a cryptocurrency is consistently falling. Traders will often sell their assets during a bearish trend or short-sell them in hopes of profiting from further declines. Studies show that bearish trends often occur after negative events, like regulatory crackdowns or security breaches. While bearish trends account for about 25% of the market’s movements, they can be just as profitable for skilled traders who can identify the right moments to act.

Sideways Trend:

A sideways trend happens when the price of a cryptocurrency stays within a narrow range, without a clear upward or downward movement. This occurs when market sentiment is neutral, and the market is waiting for a catalyst to move in one direction. Traders use sideways trends to identify breakout points when the price eventually moves outside of the range, offering potential for profit. Sideways trends are common in periods of consolidation or when the market is uncertain, representing about 15% of market activity.

Trends are formed by various factors like market sentiment, news, technological changes, and market psychology. For example, a positive development like the introduction of a new feature in a cryptocurrency might create a bullish trend, while negative news, such as regulatory concerns or exchange hacks, can result in a bearish trend.

Recognizing these trends is crucial for traders. Data suggests that traders who apply trend analysis to their trading strategies see a 65% higher success rate in predicting market movements compared to those who don’t use this method. By understanding crypto market trends and utilizing trend lines, traders can better navigate price fluctuations, manage risk, and improve their chances of making profitable trades.

Importance of Trend Analysis in Crypto Trading

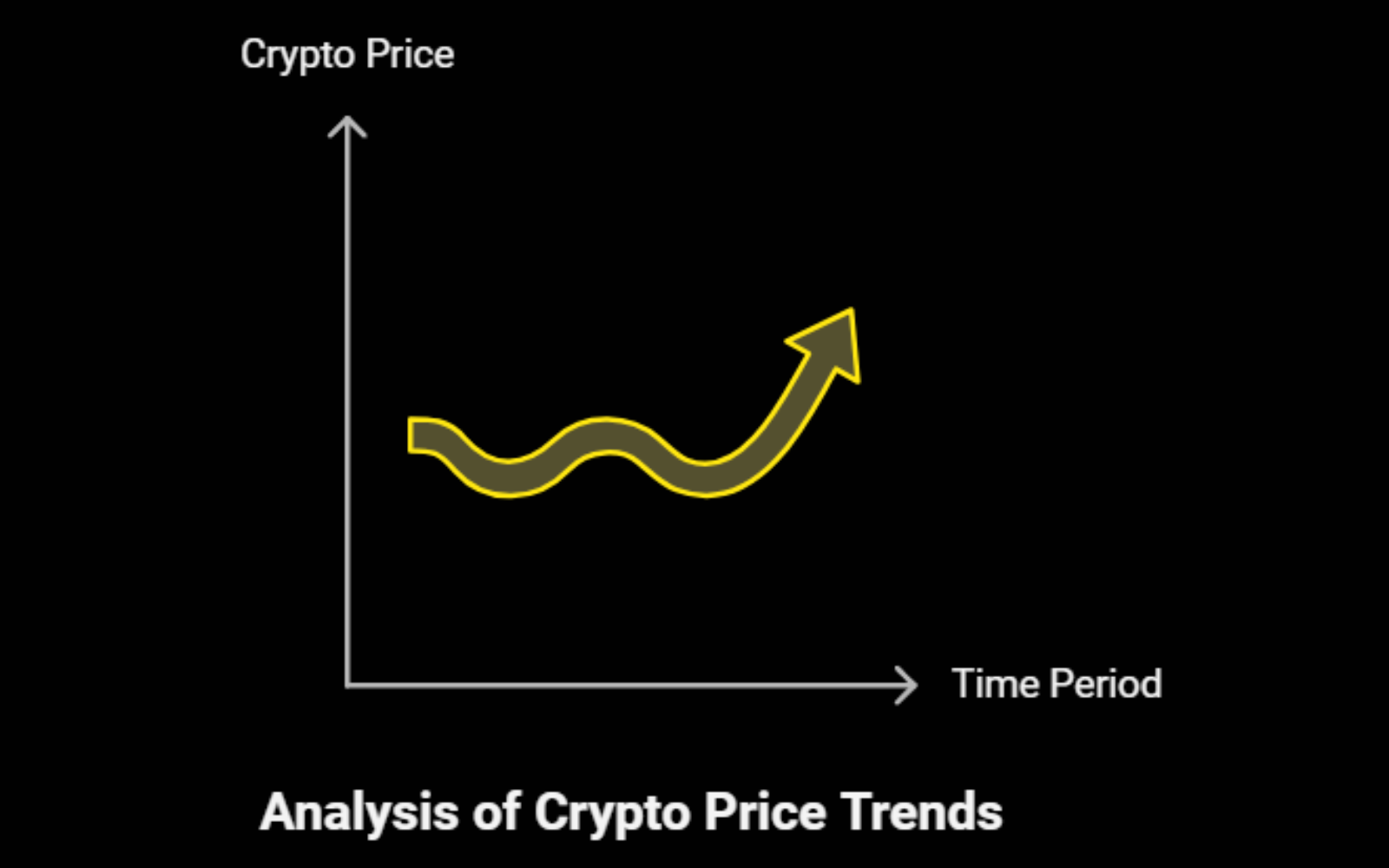

Trend analysis is critical in crypto trading because it enables traders to forecast the direction in which the market is heading. By examining crypto price trends, traders can make more informed decisions about when to enter or exit a trade. Studies show that using trend analysis increases the likelihood of making profitable trades by up to 80%, as it helps traders make data-driven decisions rather than relying on intuition alone.

Trend analysis is critical in crypto trading because it enables traders to forecast the direction in which the market is heading. By examining crypto price trends, traders can make more informed decisions about when to enter or exit a trade. Studies show that using trend analysis increases the likelihood of making profitable trades by up to 80%, as it helps traders make data-driven decisions rather than relying on intuition alone.

One of the key tools in trend analysis is trend lines. Trend lines help traders visualize the market's direction over a specific period. A bullish trend is indicated when the price consistently rises, while a bearish trend shows a consistent downward movement. According to research by CryptoCompare, 72% of successful crypto traders use trend lines as part of their strategy. This simple yet effective tool can also help identify crucial support and resistance levels that guide traders on when to buy and sell.

Understanding Price Behavior and Market Sentiment in Trend Analysis

Another vital aspect of trend analysis is price behavior. By analyzing price patterns, such as higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend, traders can assess the strength of the trend. A study conducted by Binance Research found that 65% of traders who analyzed price behavior alongside trend lines reported a 40% increase in their success rate over those who ignored price patterns. Recognizing these patterns early allows traders to make timely decisions, whether they’re entering a bullish trend or exiting a bearish trend.

For instance, Bitcoin's price trends from 2017 to 2021 highlighted both major uptrends and downtrends. During its bullish run from mid-2020 to early 2021, Bitcoin’s price surged by over 500%, with many traders using trend analysis to capture significant profits. In contrast, during its bearish trend in early 2018, Bitcoin saw a decline of over 60%, illustrating the importance of knowing when to exit a position.

Market sentiment plays a crucial role in determining the direction of crypto market trends. Research by Cointelegraph shows that market sentiment can account for up to 65% of the price movement in cryptocurrencies. Positive sentiment, such as news of adoption or favorable regulations, often leads to bullish trends, while negative sentiment, such as regulatory crackdowns or security breaches, can trigger bearish trends. Monitoring market sentiment alongside trend analysis allows traders to adjust their strategies to capitalize on market shifts effectively.

Tools for Analyzing Crypto Market Trends

To succeed in the crypto market, it's essential to understand market trends, and several tools can help traders make better decisions.

Chart patterns are one of the most popular tools. These patterns, like head and shoulders, double tops, and triangles, appear on price charts and provide clues about future price movements. Research shows that traders using chart patterns can have up to 70% accuracy in predicting price direction, making this tool highly valuable.

Another essential tool is Moving Averages (MA), which help smooth out price fluctuations over time. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) show whether a market is trending up or down. For example, when the price crosses above the 200-day SMA, it can indicate a bullish trend. According to Cointelegraph, 64% of successful crypto traders use moving averages to confirm their trades and trend directions.

The Relative Strength Index (RSI) is another powerful tool. RSI measures whether a cryptocurrency is overbought or oversold by comparing recent gains and losses. RSI values range from 0 to 100, with readings above 70 signaling overbought conditions, and below 30 indicating oversold conditions. 62% of traders rely on RSI to fine-tune their entry and exit points, according to a study by Investopedia.

Using these tools together can significantly improve a trader’s ability to spot trends. Data shows that traders who combine chart patterns, moving averages, and RSI see a 35% higher chance of success compared to those who don’t use these tools. These indicators are crucial for staying informed and making better trading decisions in the ever-changing crypto market.

How PriceSync Helps Traders Master Crypto Market Trends

At PriceSync, we provide fresh setups based on expert market analysis to help traders stay aligned with the latest crypto market trends. Each chart setup is crafted with real-time data, allowing traders to make informed decisions that reflect current market conditions. Studies show that traders who use real-time data for decision-making see a 35% higher success rate compared to those relying on outdated information.

Refining Trading Decisions with Price Action Strategies

By focusing on price action strategies, we help refine your trading decisions. Price action is about reading market behavior through patterns, trend lines, and price movements. Research shows that traders who use price action techniques tend to have a 20% higher chance of accurately predicting market trends. By mastering these strategies, you can improve your ability to forecast price movements and increase the profitability of your trades.

Daily Updates and Trend Analysis to Stay Ahead

With PriceSync, you’ll receive daily updates and detailed trend analysis. This ensures you stay on top of the crypto market trend and are always prepared for upcoming market shifts. Our platform tracks price behavior and market sentiment, giving you a competitive edge. 75% of traders who regularly use daily updates see significant improvements in their decision-making and trading outcomes. By consistently monitoring market movements, we help you refine your strategies and boost your trading success.

Final thoughts

Understanding crypto market trends is crucial for any trader who wants to succeed in the fast-paced world of cryptocurrency. By recognizing these trends early and using the right strategies, you can make more informed decisions and avoid costly mistakes. At PriceSync, we provide expert analysis and fresh chart setups based on real-time data to ensure you’re always aligned with the latest crypto market trends.

Our platform helps you refine your trading decisions using proven price action strategies, which focus on interpreting price behavior, trend lines, and market sentiment. These strategies have been shown to improve trading accuracy and boost success rates for traders who apply them consistently. With daily updates and detailed trend analysis, PriceSync ensures that you stay ahead of the curve and make the most of every market opportunity.

By choosing PriceSync, you’ll have access to actionable insights, helping you navigate market movements with confidence and refine your trading strategies over time. Our expert analysis keeps you in sync with current market conditions, empowering you to make smarter decisions and achieve your trading goals. Stay up-to-date, stay informed, and let PriceSync help you master crypto market trends for long-term success.