In the world of crypto trading, 2x leverage can be a powerful tool, offering traders the ability to amplify their potential returns. By using borrowed funds, traders can double their position size, which could lead to higher profits if the market moves in their favor. However, 2x leverage also increases the risk, as losses can also be doubled. Studies show that nearly 75% of leveraged traders face significant losses due to mismanagement of risk. On the other hand, trading without leverage means you're only using your own funds, reducing risk, but potentially lowering returns as well. Many conservative traders prefer no leverage for a safer, more sustainable approach.

In the world of crypto trading, 2x leverage can be a powerful tool, offering traders the ability to amplify their potential returns. By using borrowed funds, traders can double their position size, which could lead to higher profits if the market moves in their favor. However, 2x leverage also increases the risk, as losses can also be doubled. Studies show that nearly 75% of leveraged traders face significant losses due to mismanagement of risk. On the other hand, trading without leverage means you're only using your own funds, reducing risk, but potentially lowering returns as well. Many conservative traders prefer no leverage for a safer, more sustainable approach.

In this article, we’ll compare both strategies and help you understand which approach might be better suited to your trading style. Whether you’re aiming for more aggressive gains or looking for a safer route, PriceSync provides expert-crafted chart setups based on price action analysis to guide your trading decisions. Let’s dive into the details and explore how you can sharpen your trading skills.

What is 2x Leverage in Crypto Trading?

2x leverage in crypto trading means you’re borrowing funds to increase your position size, allowing you to trade with more capital than you actually have. Essentially, with 2x leverage, you can control twice the amount of crypto than what you initially invested. For example, if you have $1,000 and use 2x leverage, you can trade with $2,000. This is done by borrowing the extra funds from the exchange or broker, and in return, they charge interest on the borrowed amount.

Using leverage amplifies the potential returns of your trades. If the price of the cryptocurrency moves in your favor, your profits will be greater than if you traded without leverage. For instance, a 10% increase in the value of your position could result in a 20% profit if you're using 2x leverage. This is because you’re trading with borrowed money, so your returns are magnified.

However, the downside is that leverage also increases the risk. If the price of the cryptocurrency moves against your position, your losses will also be magnified. In this case, a 10% decrease could result in a 20% loss of your capital. This means that while leverage offers the potential for higher returns, it also exposes you to a greater risk of losing more than your initial investment.

The leverage ratio determines how much additional money you can borrow to trade. With 2x leverage, you are borrowing 100% of your position size, allowing you to double your exposure in the market. The higher the leverage, the more risky the trade becomes, as you’re borrowing more to amplify your position.

What Does No Leverage Mean for Crypto Traders?

No leverage trading in crypto means you are using only your own money to buy and sell assets without borrowing additional funds. Unlike 2x leverage, where you can control a position twice the size of your capital, no leverage limits your exposure to only what you invest. If you have $1,000, you can only trade with $1,000, ensuring that your risk is confined to your actual funds.

Trading without leverage keeps your profit and loss movement 1:1 with the market. If the price of a cryptocurrency increases by 10%, your position grows by 10%. Conversely, if the market drops 10%, your losses are also 10%, unlike leveraged positions where losses can be magnified. A study by the Financial Planning Association found that 77% of leveraged traders lose money, while long-term traders using no leverage tend to perform more consistently.

No leverage trading lowers your risk because there are no liquidation threats. A 10% price drop results in a 10% loss, whereas in 2x leverage, the same drop could cause a 20% loss or force liquidation. No leverage also eliminates margin call risks, meaning traders can hold positions longer without worrying about sudden forced sell-offs. Emotional stability is another advantage, as leveraged traders often panic due to market volatility, while those without leverage can make decisions based on price action analysis rather than fear.

Unlike leveraged trading, no leverage eliminates borrowing costs. Exchanges charge interest on borrowed funds, which adds expenses to every trade. With no leverage, traders avoid these fees, allowing for a more cost-effective trading approach. A report from ETF.com suggests that long-term traders without leverage see more stable growth compared to highly leveraged positions, which are prone to liquidation risks. While 2x leverage can amplify short-term gains, trading without leverage is a more sustainable option for long-term success in crypto markets.

2x Leverage: Pros and Cons

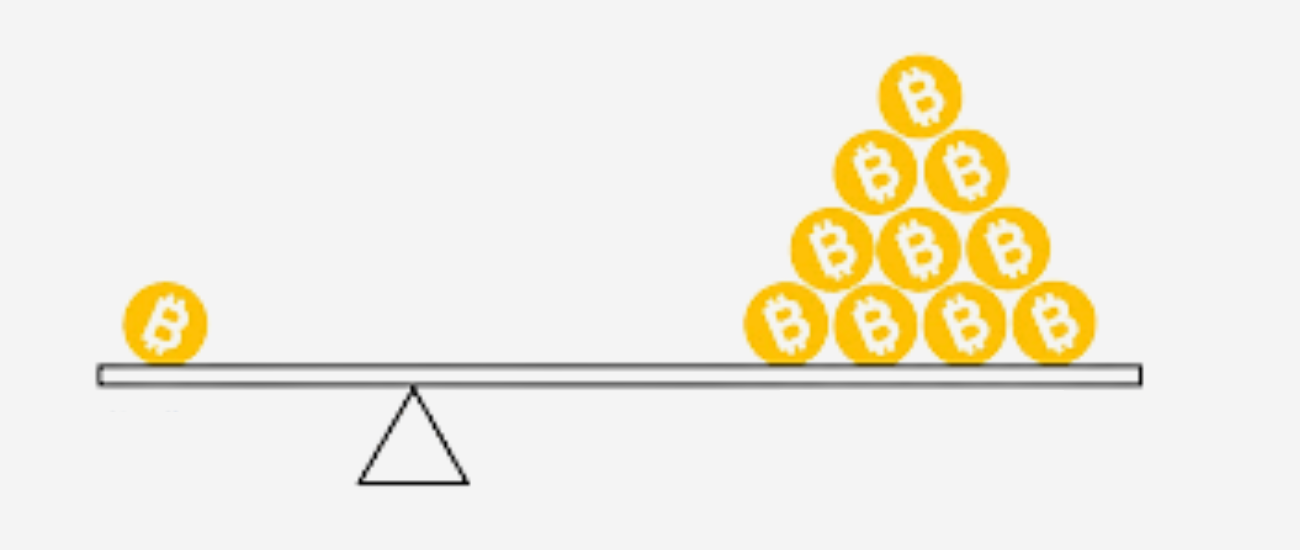

Using 2x leverage in crypto trading can be a powerful tool, but it comes with risks. While it can double your potential profits, it can also double your losses. Let’s break it down in simple terms.

Pros of 2x Leverage

Higher Potential Profits – If a trade moves in your favor, 2x leverage allows you to earn twice the profit compared to a regular trade. For example, if Bitcoin rises 5%, a leveraged position would give you a 10% return.

More Capital Efficiency – You can control a larger position with less money. Instead of buying $1,000 worth of crypto, you can control $2,000 worth using leverage.

Faster Gains for Short-Term Traders – Traders who focus on quick price moves, like scalpers and day traders, use leverage to maximize small price swings.

Hedging Strategy – Some traders use leverage to protect existing investments by opening positions in the opposite direction.

Cons of 2x Leverage

Higher Risk of Losing Money – Losses also get doubled. If the price drops 5%, your loss will be 10%. A 50% drop in price could wipe out your entire investment.

Liquidation Risk – If your position loses too much, the exchange may automatically close it, resulting in a total loss of funds. With 2x leverage, your liquidation price is 50% closer compared to a no-leverage trade.

Extra Costs – Leverage trading often comes with interest fees and funding rates, which can eat into profits, especially if holding a position for a long time.

Emotional Pressure – Leverage increases both potential gains and losses, making trading more stressful. Many traders make impulsive decisions due to fear or greed.

How 2x Leverage Affects a Trade

Let’s say you have $1,000 and want to trade Bitcoin at $50,000 per BTC.

Without Leverage: You buy 0.02 BTC. If BTC rises 10%, your BTC is now worth $1,100, giving you a $100 profit.

With 2x Leverage: You borrow an extra $1,000, so you buy 0.04 BTC. If BTC rises 10%, your BTC is now worth $2,200, giving you a $200 profit—double the return.

However, if BTC drops 10% instead:

Without Leverage: Your BTC is now worth $900, meaning a $100 loss.

With 2x Leverage: Your BTC is now worth $1,800, meaning a $200 loss. If the losses continue, your position could be liquidated, and you could lose everything.

No Leverage: Pros and Cons

Trading with no leverage is the safest way to trade crypto. While it may not offer quick, high returns like 2x leverage, it gives you full control over risk and protects your capital from sudden liquidations. Let’s go over the pros and cons.

Pros of No Leverage

Lower Risk of Losing Everything – Without leverage, you can only lose the amount you invest. A 50% price drop means you still have 50% of your capital, unlike leveraged trading, where liquidation could wipe out your position.

No Liquidation Worries – Since you’re not borrowing money, your position won’t be automatically closed by the exchange. You have the freedom to hold through market dips.

No Extra Fees – Leveraged trading often includes interest charges and funding fees, which reduce profits. No leverage means no hidden costs.

Better for Long-Term Investing – If you believe in crypto’s long-term growth, holding assets without leverage allows you to ride out market volatility without forced liquidations.

Cons of No Leverage

Slower Returns – Gains are limited to actual price movement. If Bitcoin rises 5%, your portfolio increases 5%, whereas a leveraged trader would gain 10%.

Requires More Capital for Bigger Profits – To trade a $2,000 position, you need the full amount instead of using $1,000 with 2x leverage. This limits the number of trades you can enter at once.

Less Flexibility for Short-Term Traders – Day traders and scalpers rely on small price movements. Without leverage, they may find it harder to generate large profits from short-term trades.

Can Feel Slow Compared to Leverage Trading – In a bull market, no leverage means you won’t see explosive growth as quickly as leveraged traders.

How No Leverage Trading Works in Practice

Let’s take the example of a trader, Alex, who prefers no leverage for long-term safety.

Alex has $10,000 and buys Bitcoin at $50,000 per BTC, purchasing 0.2 BTC.

If Bitcoin rises 20%, Alex’s BTC is now worth $12,000, giving a $2,000 profit.

If Bitcoin drops 20%, Alex’s BTC is now worth $8,000, meaning a $2,000 loss, but he still holds the position.

Now compare this to a 2x leveraged trader:

If Bitcoin rises 20%, they gain 40%, making $4,000.

If Bitcoin drops 20%, it loses 40%, meaning liquidation risk if its margin is too low.

Which is Better for Crypto Traders: 2x Leverage or No Leverage?

When it comes to crypto trading, the choice between 2x leverage and no leverage depends on your risk tolerance, trading style, and financial goals. Let’s compare both approaches to help you decide which suits you best.

2x Leverage vs. No Leverage: Side-by-Side Comparison

Which Option is Better for Different Types of Traders?

Risk-Tolerant Traders (Aggressive Traders)

If you're comfortable with high volatility and willing to take calculated risks, 2x leverage can help you maximize your profits in short-term trades. However, it requires strict risk management to avoid liquidation.

Risk-Averse Traders (Conservative Traders)

If you prefer consistent growth with lower risk, trading with no leverage is a better choice. It allows you to preserve capital, avoid unnecessary stress, and focus on long-term profitability.

Day Traders & Scalpers

Short-term traders looking for quick profits may prefer 2x leverage to increase their buying power. But they need to monitor positions closely to prevent heavy losses.

Swing & Long-Term Investors

Traders who hold positions for weeks or months often avoid leverage. This reduces exposure to sudden market crashes and gives them the flexibility to ride trends without liquidation risk.

Final thoughts

When it comes to 2x leverage vs no leverage, there’s no one-size-fits-all answer. 2x leverage can boost your profits, but it also increases risk. On the other hand, no leverage offers better risk management but requires patience. The key is understanding market conditions and making informed decisions.

At PriceSync, we provide expert price action chart setups to help you navigate the market with confidence. Whether you prefer high-risk, high-reward trades or a steady, controlled approach, our fresh setups keep you in sync with the market.

So, what’s your trading style-do you prefer 2x leverage, or do you trade without leverage for safety? Let us know!

And remember trading starts with the right insights. Stay ahead with PriceSync’s daily chart setups and take your trading to the next level!